Short Sale vs Foreclosure: What’s the Difference?

-

Codee Chessher

- Last updated:

When you’re underwater on your mortgage, it’s hard to decide what your best course of action is. If you continue to not pay your mortgage, your lender will eventually foreclose on the home. One popular alternative is a short sale, which can get you out of a mortgage contract without the detrimental consequences that a foreclosure would have.

In this article, we detail how the two processes are similar, how they differ, and how to decide which is right for you.

Quick Details for Short Sale/Foreclosure

| Short sale: When the lender allows the homeowner to sell a home for less than what they owe on the mortgage; short-term hit to your credit score | Foreclosure: When the lender repossesses the home for nonpayment; long-term hit to your credit score |

At A Glance

- Home is worth less than the mortgage

- Home is sold by owner for less than market value

- Voluntary process initiated by homeowner

- Can take up to a year

- Home value is irrelevant

- Home is repossessed by lender for nonpayment

- Involuntary process initiated by lender

- May take 60 days to 2 years, depending on the mortgage

Key Similarities

- Both processes will get the homeowner out of the mortgage contract

- Short sales and foreclosures both negatively affect your credit

- Both options will negatively affect your prospects of getting a mortgage in the future

Overview of Short Sale:

For a short sale to occur, the home’s market value has to first be lower than the unpaid balance left on your mortgage during pre-foreclosure. You can ask the lender to approve a short sale at any time, but it’s most common during the 3-6 month mark before foreclosure proceedings officially begin.

Homeowners have to convince their lender that a short sale is justified, typically because of a financial hardship. Death of a breadwinner, divorces, loss of jobs, and serious injuries are a few common reasons people make use of short sales. There’s a catch: for the lender to accept your justification, it must be a recent event that wasn’t disclosed to them at the time you signed for the mortgage.

Here’s an example of a short sale: you signed a $300,000 mortgage agreement with a lender. Some time later, you break your leg and can’t afford your mortgage anymore because you can’t work. Let’s say the home has depreciated and is only valued at $150,000, but you have $175,000 left on your mortgage. A short sale will allow you to sell it for $150,000, but what about the remaining $25,000?

That’s called the deficiency, and whether you have to pay it or not depends on your lender. They can choose to forgive the deficiency and release you from your obligations, or pursue a deficiency judgment in court to force you to pay the deficiency. You’re also usually on the hook for any closing and selling costs. The greater the deficiency, the more likely the lender is to pursue a deficiency judgment, but it depends on your arrangement with the lender. Lastly, deficiency judgments go on your credit reports and negatively impact your credit score.

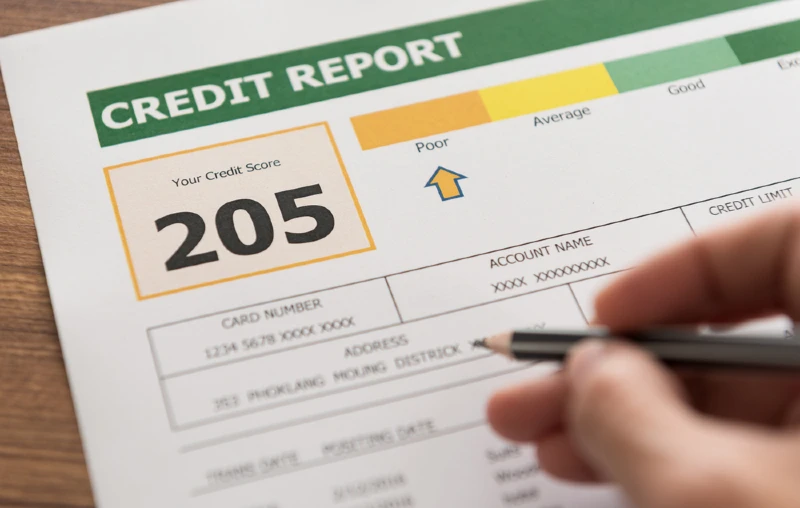

How It Affects Credit

Short sales are bad for your credit, but not as bad as a foreclosure. For those with an excellent or good credit score, a short sale can drop your credit score from 100 to 150 points! They also follow you around for up to seven years, which is when they automatically drop off your credit reports.

Short sales are a black stain on your credit, but they’re generally preferable to a foreclosure. You may not be able to find another loan or mortgage soon after a short sale, and the effect on your credit can last up to seven years. Still, a short sale doesn’t disqualify you from government-sponsored loans like Fannie Mae or Freddie Mac loans.

How Soon After a Short Sale Can I Get a Mortgage?

It depends on the lender and how much money you have to offer as a down payment. Because short sales damage your reliability, lenders require more money down after a short sale. If you have less than 10% of a down payment for a home, you’ll usually have to wait up to seven years to get another mortgage. Between 10% and 20% down, and you may only wait four years. If you can supply more than 20% down, a lender may be more inclined to work with you.

When to Choose

A short sale may be right for you if you’ve suffered a catastrophic financial hardship like an injury, death, or the loss of a job in the family. Supply the lender with documentation proving your hardship and explain that you want to pursue a short sale rather than go through with foreclosure.

Short sales are generally advantageous for both the lender and homeowner. The lender doesn’t have to go through a lengthy foreclosure process or sell the home, which is depreciating anyway. The homeowner gets released from their mortgage and takes a hit to their credit. Broadly speaking, a lender will only approve a short sale if they think it will make/save them more money than a foreclosure.

- Allows both lender and borrower to rid themselves of a depreciating home

- Lets the borrower reduce financial obligations after a financial hardship

- Avoids the lengthy, expensive foreclosure process

- Encourages homeowners to keep the home in good condition for sale

- Less drastic effect on credit than foreclosure

- Borrower may be financially liable for the deficiency

- Borrower has to find an agent to sell the home

- Must supply documentation proving that a financial hardship justifies the short sale

- Lenders can reject the prospect of a short sale

Overview of Foreclosure:

Foreclosure is when a lender takes action to repossess a home after the lender doesn’t pay the mortgage for a predetermined amount of time. The first step is the first missed payment, which the lender reports to credit bureaus. After this, the process varies by state law. In some states a lender may continue to report missed payments for as long as six months before initiating foreclosure.

Lenders usually try to offer loss mitigation options before resorting to foreclosure because it’s a long, expensive process for them. A few of these include forbearances (temporary pause on payments), modifications (changes the terms of the mortgage to reduce financial strain), short sales, and repayment plans. Lenders usually don’t mind offering these options as long as there’s a good reason and the borrower maintains open communication.

Exactly how a foreclosure occurs depends on whether it’s a judicial or nonjudicial foreclosure. Judicial foreclosures are allowed in all states and sometimes required, while nonjudicial foreclosures are allowed by fewer states and required by none.

Judicial foreclosure is the more common process, where a lender has to file a civil lawsuit against you and go through court proceedings in order to repossess the home. The borrower can dispute the foreclosure and extend the process or do nothing, which hastens the process.

An important note is that borrowers have no incentive to maintain or repair a home in foreclosure or pre-foreclosure, unlike with a short sale. By the time the lender repossesses the home, it may require significant investment before it’s able to be listed on the real estate market.

How It Affects Credit

Foreclosures are an indelible stain on your credit that only washes away after seven years. Those with excellent credit can expect a foreclosure to drop their credit score by up to 160 points, and up to 100 points for those with a good credit score. This can have a drastic effect on whether you can get loans, finance vehicles, apply for credit cards, and more.

How Soon After a Foreclosure Can I Get a Mortgage?

Foreclosures disqualify you from most government-sponsored loans for several years and can freeze you out of the housing market during that time. However, different types of loans have variable mandatory waiting periods after a foreclosure. These waiting periods begin from the date of your first delinquent mortgage payment.

If you want to get a mortgage, it’s important to be aware of how long you must wait. Let’s see how long some common home loans make you wait after a foreclosure.

- Freddie Mac or Fannie Mae loan: 7 years

- USDA loan: 3 years

- Federal Housing Authority (FHA) loan: 3 years

- Veteran Affairs (VA) loan: 2 years

When to Choose

Like bankruptcy, foreclosures are catastrophic events, and nobody actually wants to go through with them. However, a foreclosure can be perfect if you just want to get rid of your mortgage and don’t care about taking a hit on your credit. Because short sales require you to pay an agent and pay for the costs of selling the home, foreclosure may be the only option left if the borrower has little or no money.

We highly recommend avoiding foreclosure whenever possible by taking advantage of loss mitigation options. If the situation is financially untenable, though, there may be little choice but to allow the lender to foreclose on the home.

- Frees the borrower from their obligation to pay the mortgage

- Lender is able to recoup their investment by selling the home

- Borrower can save money that would have otherwise gone to the mortgage during foreclosure

- Precipitously drops credit score for up to 7 years

- Disqualifies borrower from many popular government-sponsored loans

- Borrower loses their place to live

- Borrower may face difficulties getting a loan, credit card, or financing a vehicle

- Interest rates for future loans will rise

Conclusion

Foreclosures are the inevitable result of not paying your mortgage, but a short sale can help reduce some of the impacts on your credit. The downside is that the house has to be depreciating, and you have to prove there’s a good reason for the short sale. Otherwise, a foreclosure can free you from financial obligations at the cost of a credit score drop and temporary disqualification from future mortgages.

Featured Image Credit: Left – Short Sale (Andy Dean Photography, Shutterstock) | Right – Foreclosure (Andy Dean Photography, Shutterstock)

Contents